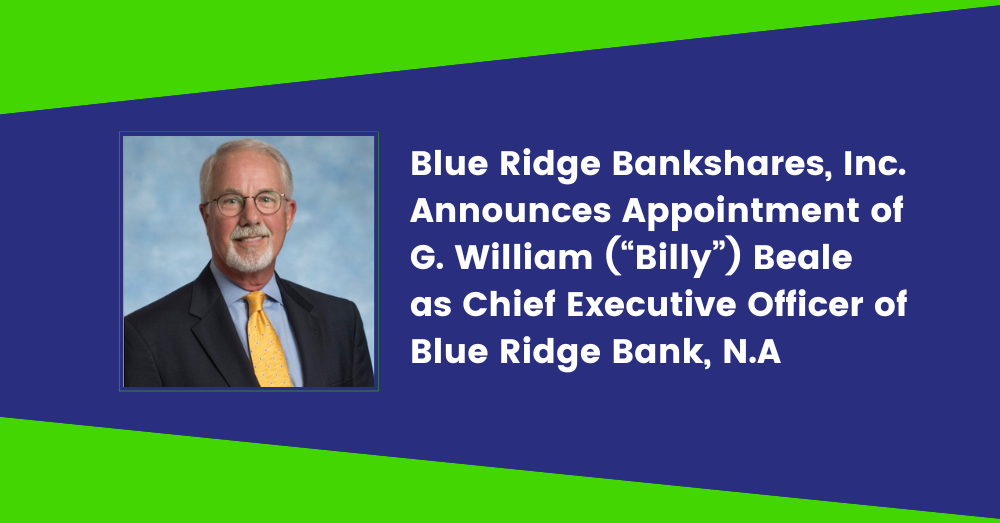

Blue Ridge Bankshares, Inc. Announces Appointment of G. William ("Billy") Beale as Chief Executive Officer of Blue Ridge Bank, N.A.

05/08/2023

Blue Ridge Bankshares, Inc., the holding company of Blue Ridge Bank, N.A. and BRB Financial Group, Inc., today announced that G. William (“Billy”) Beale has been appointed as Chief Executive Officer of the Bank, effective as of May 7, 2023.

Brian K. Plum will continue as President and Chief Executive Officer at the holding company. Mr. Plum will focus on broader strategy, technology and business line initiatives to further advance the Company’s Strategy Statement: Blue Ridge Bank is an innovative, comprehensive financial services company of choice dedicated to a frictionless client experience.

“Over the past 15 years, Blue Ridge Bank has grown from a small community bank to a leading Virginia bank with a robust deposit base, deep customer relationships and growing footprint,” said Mensel D. Dean, Jr., Chairman of the Board. “As we considered the growth opportunities available to the Bank, in addition to the increasing complexity and challenges in the banking industry, we believe it is important to add depth and experience to our team so we can continue to effectively build on the strong foundation that Brian and the team have created. Billy is a seasoned banking executive with a deep understanding of the regional banking sector, and the Board is confident that we will benefit greatly from his operational expertise.”

Mr. Dean concluded, “We are pleased that Brian will continue to lead our holding company. As CEO over the last eight years, he has overseen the Bank’s tremendous growth and brand recognition, developed diversified income sources and modernized our operations and capabilities. We expect to continue to benefit from his guidance in his role at the Company and are excited about what Brian, Billy and our talented team will achieve together.”

“I am excited to have the opportunity to join this team at a critical time in the banking industry,” said Mr. Beale. “Blue Ridge Bank has a unique community banking model with strong credit quality, diverse revenue streams, robust local market teams and sophisticated and innovative products. Together, we will continue to execute our strategies to grow the franchise and enhance the Bank’s fee-based business. I look forward to working with the Board, Brian and the rest of the management team to reach even greater heights.”

“The Blue Ridge team has accomplished a tremendous amount working together in recent years,” said Mr. Plum. “Billy joining the team to lead Blue Ridge Bank provides the Company with an experienced and successful bank executive who will be additive as we work to create shareholder value. I have watched and admired Billy’s success during my career and am incredibly pleased to have him join Blue Ridge as a teammate. I am looking forward to building on Blue Ridge’s success together.”

About G. William Beale

G. William Beale served as the President and Chief Executive Officer of Community Bankers Bank from November 2018 to July 2020, and currently remains on its board. From May 1989 to March 2017, Mr. Beale worked for Union Bank & Trust (now known as Atlantic Union Bank) and was appointed CEO in 1991. During his tenure, he grew the bank’s total assets from $180 million to $8.5 billion and created a total shareholder return of 10x. Prior to Union Bank & Trust, he worked as both an executive and commercial lender for Capital Bank and Security Bank from 1971 to 1989. Mr. Beale graduated from the Southwestern Graduate School of Banking at Southern Methodist University in 1981 and received a Bachelor of Science in Business Administration from The Citadel in 1971.

About Blue Ridge Bankshares, Inc.

Blue Ridge Bankshares, Inc. is the holding company for Blue Ridge Bank, National Association. The Company, through its subsidiaries and affiliates, provides a wide range of financial services including retail and commercial banking, insurance, card payments, wholesale and retail mortgage lending, and government-guaranteed lending. The Company also provides investment and wealth management services and management services for personal and corporate trusts, including estate planning, and trust administration. Visit www.mybrb.bank for more information.

Forward Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company's beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and are typically identified with words such as "may," "could," "should," "will," "would," "believe," "anticipate," "estimate," "expect," "aim," "intend," "plan," or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on its expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company's control. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. The following factors, among others, could cause the Company's financial performance to differ materially from that expressed in such forward-looking statements: (i) the strength of the United States economy in general and the strength of the local economies in which it conducts operations; (ii) changes in the level of the Company's nonperforming assets and charge-offs; (iii) management of risks inherent in the Company's real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of collateral and the ability to sell collateral upon any foreclosure; (iv) the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Federal Reserve, inflation, interest rate, market, and monetary fluctuations; (v) changes in consumer spending and savings habits; (vi) the Company's ability to identify, attract, and retain experienced management, relationship managers, and support personnel, particularly in a competitive labor environment; (vii) technological and social media changes impacting the Company, the Bank, and the financial services industry in general; (viii) changing bank regulatory conditions, laws, regulations, policies, or programs, whether arising as new legislation or regulatory initiatives, that could lead to restrictions on activities of banks generally, or the Bank in particular, more restrictive regulatory capital requirements, increased costs, including deposit insurance premiums, increased regulations, prohibition of certain income producing activities, or changes in the secondary market for loans and other products; (ix) the impact of changes in financial services policies, laws and regulations, including laws, regulations and policies concerning taxes, banking, securities and insurance, and the application thereof by regulatory bodies; (x) the Company's involvement, from time to time, in legal proceedings and examination and remedial actions by regulators; (xi) the impact of, and the ability to comply with, the terms of the formal written agreement between the Bank and the Office of the Comptroller of the Currency; (xii) the impact of changes in laws, regulations, and policies affecting the real estate industry; (xiii) the effect of changes in accounting policies and practices, as may be adopted from time to time by bank regulatory agencies, the Securities and Exchange Commission ("SEC"), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, or other accounting standards setting bodies; (xiv) the impact of the COVID-19 pandemic, including the adverse impact on our business and operations and on the Company's customers which may result, among other things, in increased delinquencies, defaults, foreclosures and losses on loans; (xv) the occurrence of significant natural disasters, including severe weather conditions, floods, health related issues, and other catastrophic events; (xvi) geopolitical conditions, including acts or threats of terrorism and/or military conflicts, or actions taken by the U.S. or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the U.S. and abroad; (xvii) the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; (xviii) the willingness of users to substitute competitors' products and services for the Company's products and services; (xix) the Company's inability to successfully manage growth or implement its growth strategy; (xx) reputational risk and potential adverse reactions of the Company's customers, suppliers, employees or other business partners; (xxi) the effect of acquisitions the Company may make, including, without limitation, disruption of employee or customer relationships, and the failure to achieve the expected revenue growth and/or expense savings from such acquisitions; (xxii) the Company's participation in the Paycheck Protection Program established by the U.S. government and its administration of the loans and processing fees earned under the program; (xxiii) the Company's involvement, from time to time, in legal proceedings, and examination and remedial actions by regulators; (xxiv) the Company's potential exposure to fraud, negligence, computer theft, and cyber-crime; (xxv) the Bank's ability to effectively manage its fintech partnerships, and the abilities of those fintech companies to perform as expected; (xxvi) the Bank's ability to pay dividends to the Company; and (xxvii) other risks and factors identified in the "Risk Factors" sections and elsewhere in documents the Company files from time to time with the SEC.

SOURCE Blue Ridge Bankshares, Inc.