You Manage Your Business - Do You Manage Your Cash Flow

08/21/2025

By: Ray Knott

Entrepreneurs often start businesses with passion, skill, and determination. They manage products, people, and growth—but many overlook one critical component: cash flow management. Cash flow is one of the most critical financial concerns for businesses of all sizes, but especially for small to medium sized businesses. These businesses typically operate on thinner margins, with fewer resources and less financial cushion than larger enterprises. From paying employees to restocking inventory, reliable cash flow is essential to stay competitive, meet obligations, and take advantage of growth opportunities. Poor cash flow management is consistently cited as a top reason businesses struggle or, worse, fail.

This white paper explores the gap between business management and cash management, outlines common obstacles, and offers actionable strategies to gain control over cash flow before it controls the business.

The Cash Flow Conundrum.

It’s a story we hear often: a growing business, strong sales, happy customers—and then, a cash crunch. Managing your business means making countless decisions every day but overlooking cash flow is like driving a car without checking the fuel gauge. You’re managing, but you’re flying blind.

Key Insight:

“82% of business failures are due to poor cash flow management.”

(Source: research done by Jessie Hagen, formerly with U.S. Bank)

Why Smart Business Owners Struggle with Cash Flow.

Running a business and managing its finances are two very different skill sets. The reasons business owners struggle with cash flow include:

Irregular Revenue Streams. Many businesses, especially service providers, contractors, and seasonal businesses, do not generate steady revenue month-to-month.

Impact: Difficulty budgeting, unexpected shortfalls, reliance on personal funds, or emergency loans.

Late Payments from Customers. Businesses often lack leverage to enforce prompt payment terms and may avoid pushing back on slow-paying customers for fear of losing business.

Impact: Delayed cash inflows, need to borrow for operating expenses, or strained vendor relationships.

Limited Access to Credit or Capital. Many businesses face barriers to securing affordable credit due to limited collateral, thin credit files, or inconsistent revenues.

Impact: Missed opportunities for growth or survival during downturns.

Lack of Financial Expertise or Tools. Owners can be juggling multiple roles and may not have in-house accounting or finance staff—or access to the latest cash flow tools.

Impact: Inadequate cash forecasting, missed warning signs, or poor planning.

Upfront Costs vs. Delayed Revenue. Businesses frequently incur expenses well before realizing income (e.g., paying for materials, labor, or marketing before a sale is completed).

Impact: Ongoing cash crunches and difficulty scaling.

Dependence on a Few Key Clients. Majority of the business is tied to a concentrated set of customers increases vulnerability if payments are delayed or a major client leaves.

Impact: Increased cash flow volatility and business risk.

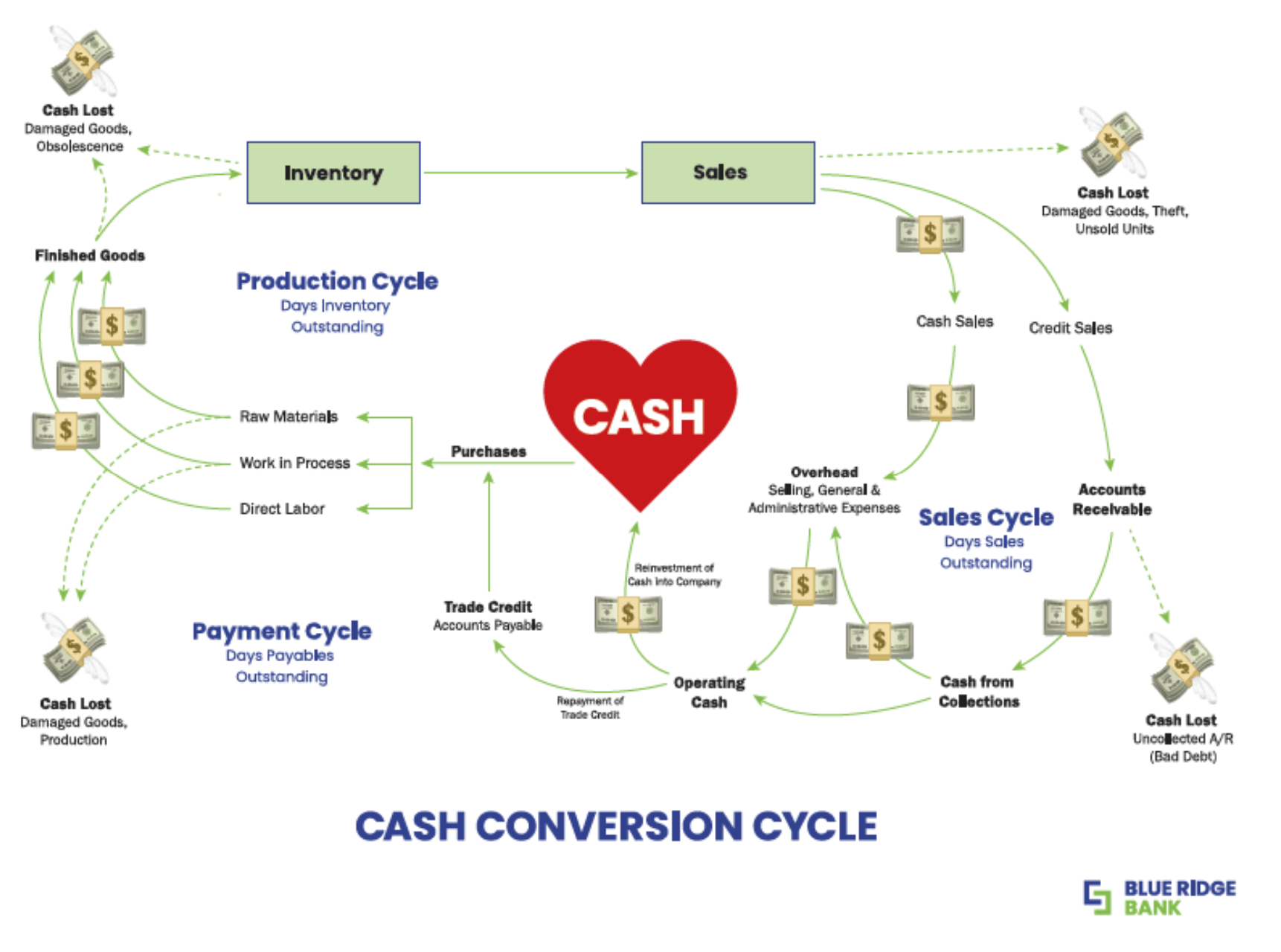

Lack of understanding of their cash conversion cycle. The Cash Conversion Cycle (CCC) is a fundamental financial metric that measures how efficiently a business turns its investment in inventory and other resources into cash.

The Cash Conversion Cycle

The Cash Conversion Cycle (“CCC”) is a critical indicator of a company’s short-term financial efficiency. It represents the number of days it takes for a business to purchase inventory (the Production Cycle), sell goods (the Sales Cycle), and collect the resulting cash from customers (the Payment Cycle). A shorter cycle means quicker cash generation and less reliance on external funding.

Why the CCC Matters

Cash Flow Management - A short CCC improves liquidity, enabling businesses to meet payroll, reinvest in growth, or reduce borrowing.

Operational Efficiency - CCC provides insight into how well a business is managing its inventory, sales process, and supplier relationships.

Financial Health - A long CCC may indicate cash flow stress, poor collections, or inefficient inventory management — all red flags for lenders and investors.

The Cost of Ignoring Cash Flow

Ignoring cash flow leads to more than stress. It results in:

-

Missed payroll or supplier payments

-

Damaged creditworthiness

-

Inability to capitalize on growth opportunities

-

Business failure—even when profitable on paper

Steps to Take Control of Your Cash Flow

1. Understand Your Cash Conversion Cycle

2. Create a Rolling Cash Flow Forecast

3. Speed Up Receivables

4. Negotiate Payables

5. Keep a Cash Reserve

6. Use Technology

How A Commercial Banker Can Help

One of the most important questions you can ask yourself as a business owner is, “Where is my expertise? Where do I need to supplement it?” Finance and treasury management are two of the areas where business owners benefit from having a solid external banking advisor. In fact, that should be an expectation of every business owner when it comes to their commercial banking relationship. When it comes to making sure that your cash flow is optimized, here's where they can help:

-

Cash Flow Analysis: They can conduct a thorough analysis of your current cash flow situation to pinpoint patterns, bottlenecks and areas that need to be addressed.

-

Optimizing Receivables: Your commercial banker can help you with determining working capital support options to ensure you maintain access to adequate levels of cash. Furthermore, they can help you install electronic payment solutions to help speed up your collections.

-

Managing Payables: At the other end of the cash payment spectrum is the relationship with your suppliers. Your commercial banker can help you with credit products to provide vendor payments to meet credit terms or achieve early payment discounts. Additionally, they can assist with electronic solutions related to automated systems for managing your payables more efficiently.

-

Financing Solutions: Naturally, your banker is there to provide just-in-time access to short-term credit or loans that can be used to cover temporary cash shortages. In addition, they can work with you with special financing solutions if your business is under a particularly acute cash crunch.

-

Cash Management Services: Certain aspects of your cash flow management approach can and should consider automation. This includes tools such as sweep accounts that automatically transfer excess funds into interest-bearing accounts overnight. This allows you to keep your cash at work, or zero balance accounts, to consolidate funds and optimize liquidity management.

-

Risk Management Advice: Managing cash is more than just the money in the account. It is, of course, subject to external risks such as currency fluctuations or interest rate changes. Your banker can be very instrumental in helping you hedge against these risks.

-

Networking Opportunities: This is one area where working with a community-based commercial banker has real benefits. They can help you connect your business with other clients or partners who might offer beneficial services or collaborations that could enhance everyone’s operations and improve cash flow indirectly.

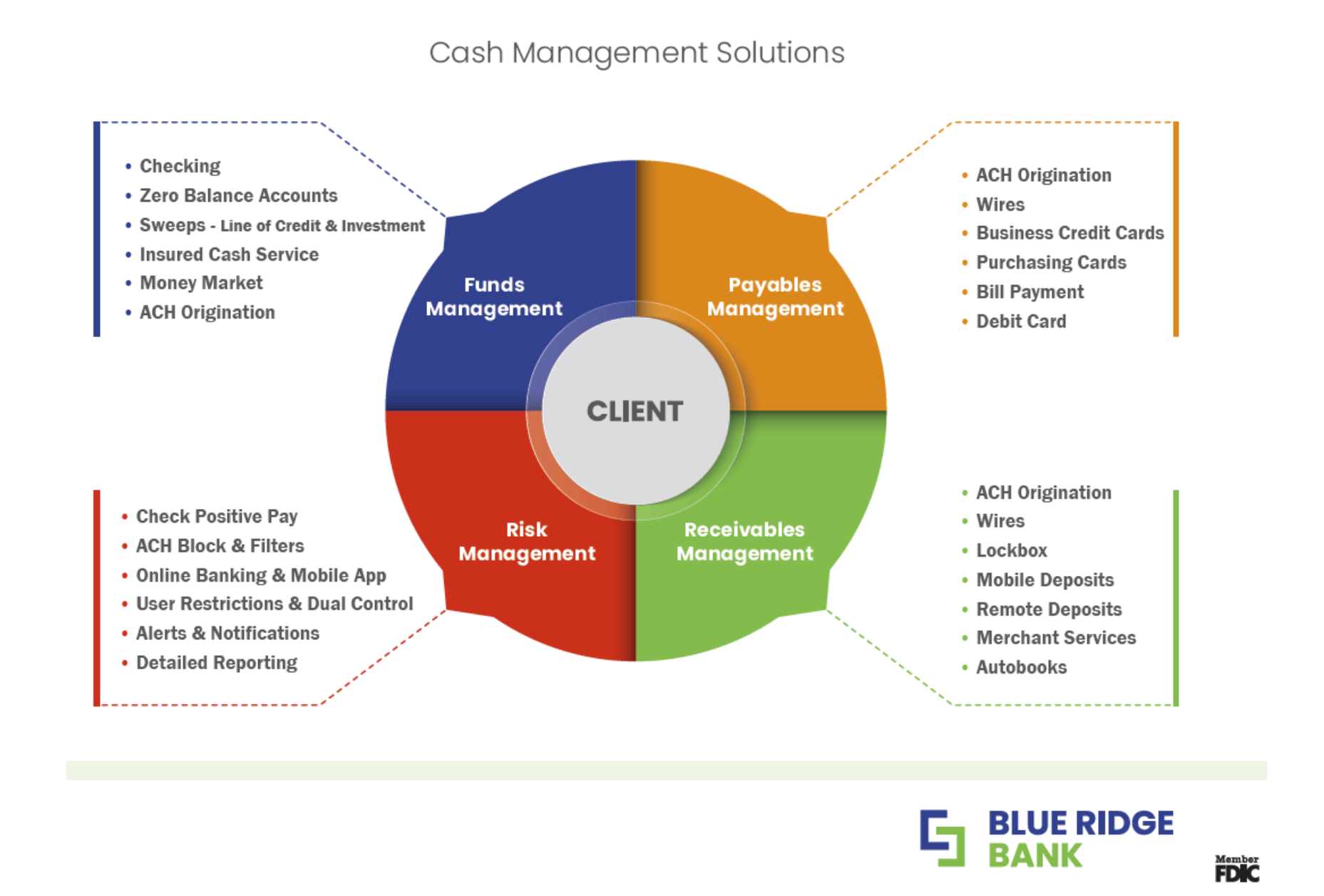

Lastly your commercial banker can assist in bringing a suite of cash management products and services to your business. These products and services can assist you in funds management, payables management, receivables management and risk management. The illustration below provides a summary of the resources that can assist in managing your cash flow as successfully as you have managed your business.

If you are looking for a better understanding of your cash flow, access to working capital, or improved cash management and payments solutions, Blue Ridge Bank is here to help. Blue Ridge has bankers who dedicate the time to getting to know your business, leverage hands-on experience with your industry, and create customized solutions for the needs of your business. Whether you need insights or want to further improve the cash flow characteristics and management capability of your small business, we invite you to contact us.

You manage your business, so let us assist you in managing your cash flow.