2025 Louisa Biz Expo - See You There!

09/10/2025

Blue Ridge Bank is excited to attend the Lousia Biz Expo on Thursday, September 18th, 2025. This free community event blends the energy of a local festival with the value of business-to-business networking, career opportunities, and community engagement.

Read More

You Manage Your Business - Do You Manage Your Cash Flow

08/21/2025

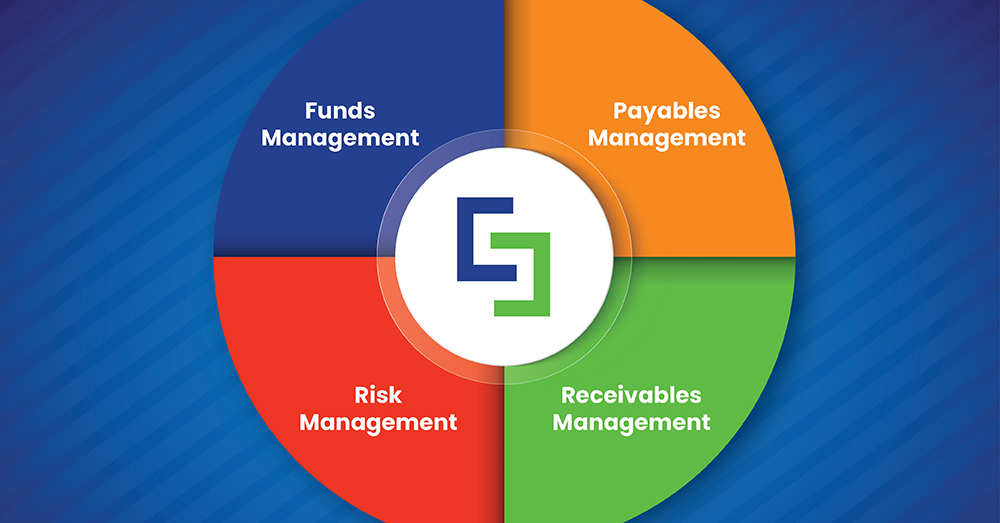

Entrepreneurs often start businesses with passion, skill, and determination. They manage products, people, and growth, but many overlook one critical component: cash flow management. This white paper explores the gap between business management and cash management, outlines common obstacles, and offers actionable strategies to gain control over cash flow before it controls the business.

Read More

Customer Appreciation Day 2025 Recap

05/29/2025

Across the entire BRB footprint on Friday, May 16th 2025 our branches hosted in-person Customer Appreciation Days. Our staff loved connecting with customers while serving refreshments throughout the day.

Read More

Customer Appreciation Day 2025

04/22/2025

Across the entire BRB footprint, we will have an in-person Customer Appreciation Day next month on Friday, May 16th, 2025. Branches will serve refreshments throughout the day and have door prizes. Please reach out to your local BRB representative for details.

Read More

Cybersecurity Tips for Seniors

04/18/2025

Social Engineering (also known as people hacking) is the art of manipulating, influencing, or deceiving others to gain access to confidential information or protected systems. Social engineering is highly effective as it exploits our human tendency to be polite, err under pressure, and the basic desire to feel good about ourselves. As technical defenses continue to improve, cybercriminals have learned that it is often easier to exploit people than to find a network or software vulnerability.

Read More